MACD Indicator

The MACD indicator is basically a refinement of the two moving averages system and measures the distance between the two moving average lines. MACD is an acronym for Moving Average Convergence Divergence.

MACD was developed by Gerald Appel and is discussed in his book, The Moving Average Convergence Divergence Trading Method.

MACD Trading Signals

The MACD indicator is primarily used to trade trends and should not be used in a ranging market. Signals are taken when MACD crosses its signal line, calculated as a 9 day exponential moving average of MACD.

Trending Market

First check whether price is trending. If the MACD indicator is flat or stays close to the zero line, the market is ranging and signals are unreliable.

- Go long when MACD crosses its signal line from below.

- Go short when MACD crosses its signal line from above.

Signals are far stronger if there is either:

- a divergence on the MACD indicator; or

- a large swing above or below the zero line.

Unless there is a divergence, do not go long if the signal is above the zero line, nor go short if the signal is below zero. Place stop-losses below the last minor Low when long, or the last minor High when short.

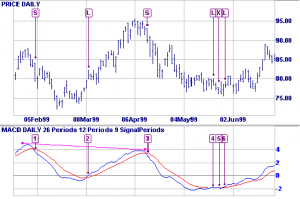

Example 1

Microsoft Corporation chart with: MACD, and MACD signal line.

- Go short [S] – MACD crosses to below the signal line after a large swing.

- Go long [L] when MACD crosses to above the signal line.

- Strong short signal [S] – the MACD crosses after a large swing and bearish divergence (shown by the trendline).

- Go long [L]. Flat MACD signals that the market is ranging – we are more likely to be whipsawed in/out of our position.

- Exit long trade [X] but do not go short – MACD is significantly below the zero line.

- Re-enter your long trade [L].

MACD Setup

The default settings for the MACD indicator are:

- Slow moving average – 26 days

- Fast moving average – 12 days

- Signal line – 9 day moving average of the difference between fast and slow.

- All moving averages are exponential.

See Indicator Panel for directions on how to set up an indicator. See Edit Indicator Settings to change the settings.

Captions and trendlines: Use MACD Histogram if you want to draw trendlines or place captions on the histogram. Otherwise, they are left “hanging in the air” if you zoom or change time periods.

MACD Formula

The MACD indicator is calculated as the difference between the fast and slow moving averages:

MACD = 12 Day exponential moving average – 26 Day exponential moving average

The signal line is calculated as a 9 day exponential moving average of MACD.

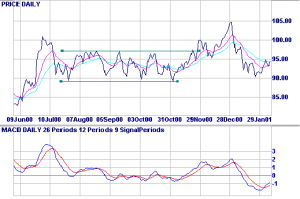

Example 2

Johnson & Johnson with a 12 day , and a 26 day exponential moving average (EMA) plotted on the price chart. MACD reflects the difference between the fast and slow EMA. The signal line is a 9 day EMA of the MACD indicator.

- MACD is furthest from the zero line when the gap between the two EMAs is widest.

- MACD is at zero when the two EMAs cross (the trading signal when using two moving averages).

- MACD fluctuates between 1.0 and -1.0 when the market is ranging.