Today, we discussed how to combine breakout and pullback entries to take advantage of a chart set-up and maximize your risk/reward profile for increased robustness. There are times when an initial set-up will present an opportunity to trade along the path of least resistance in multiple entries so as to increase profit potential whole mitigating risk. In the long-run this can lead to a robust risk management profile.

Whether you are a new trader building a foundation or an experienced trader struggling (happens to the best), here are 4 ideas for Building Confidence in Trading

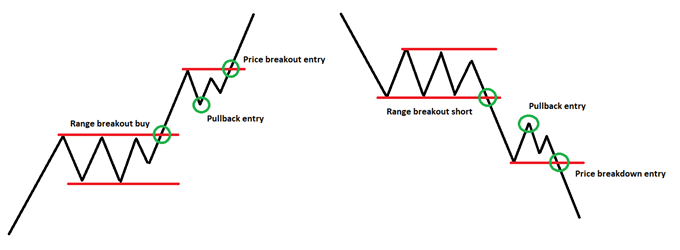

Different Approaches to the Same Chart Set-up

One aspect to trading which is highly dynamic, is how one approaches executing a trade set-up. You can have two traders identify the same technical situation and agree on the direction in which the market is to set to move next. But, the method for entry between the two traders can be slightly or even significantly different, and both could take advantage of the same set-up in their own separate ways and have similar outcomes.

Breakout/pullback entry

For example, a currency pair may be undergoing a period of consolidation. Once it breaks out of the congestion, or range, one trader may favor playing the breakout, while another opts to wait for the first pullback to develop.

Then there is the trader who looks to utilize both a breakout and pullback methodology to increase position size when the trade is moving in their favor. That is, enter a portion of the trade upon the breakout as we discussed in our recent breakout trading webinar, then add to the position on the first pullback post-breakout.

The advantage of taking this approach hinges on the improvement of the trade’s risk/reward profile. While the breakout trade is in the money (showing a profit), another portion can be added to the trade on a pullback, ideally the first one. It’s an excellent way to add to a winning position while keeping the downside in check.

We understand the difficulties of trading, which is why we’ve put together a variety of guides designed to help traders of all experience levels.

Pullback/breakout entry

The sequence doesn’t have to be in the order of a breakout entry followed by a pullback entry, it could be the other way around. For example, in a downward trending market there might be a solid pullback opportunity to take advantage of. (Check out this webinar we recently had on pullback trades.)

Once in the pullback trade the prior low could be used to enter into a breakout trade as it is breached (vice versa for a long position). Again, as was the case with the breakout/pullback sequence, you will be entering your second part of the trade while the first part is in-the-money.

Diagram of Multiple Entry Opportunities

See video for real world examples

Increased robustness in risk management

As previously mentioned, this way of taking advantage of set-ups provides you the opportunity to enhance your risk/reward profile, and in some cases significantly so. By adding to winners while in the money and treating the two entries separately, you put yourself in position to be in a trade with more size when right and smaller size when you’re wrong.

Trading size on either entry will vary from trader to trader. This will depend on your preference for trading breakouts or pullbacks, typically one entry type is favored, even if only marginally, than the other. There is no right or wrong formula here, the more important factor is consistency in application over time.

Not every initial set-up will offer these types of opportunities, of course, but when they do your bottom line can receive a significant boost. Not only will you be bolstering your risk management strategy, but you will also be alleviating the need to be right.